Rumored Buzz on Eb5 Investment Immigration

Rumored Buzz on Eb5 Investment Immigration

Blog Article

Indicators on Eb5 Investment Immigration You Should Know

Table of ContentsExamine This Report on Eb5 Investment ImmigrationThe Of Eb5 Investment ImmigrationSee This Report on Eb5 Investment ImmigrationSee This Report on Eb5 Investment ImmigrationHow Eb5 Investment Immigration can Save You Time, Stress, and Money.

While we make every effort to offer accurate and updated material, it needs to not be considered legal suggestions. Immigration legislations and policies go through alter, and individual circumstances can vary widely. For personalized guidance and lawful advice concerning your details migration circumstance, we strongly recommend speaking with a certified migration lawyer that can supply you with customized assistance and guarantee compliance with existing regulations and laws.

Citizenship, with financial investment. Currently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Locations and Rural Locations) and $1,050,000 elsewhere (non-TEA areas). Congress has actually authorized these amounts for the next 5 years starting March 15, 2022.

To receive the EB-5 Visa, Capitalists must develop 10 full time U.S. work within two years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement ensures that financial investments contribute directly to the U.S. task market. This uses whether the tasks are developed straight by the business venture or indirectly under sponsorship of a designated EB-5 Regional Center like EB5 United

Some Known Questions About Eb5 Investment Immigration.

These work are determined through models that use inputs such as growth prices (e.g., construction and devices expenses) or annual earnings created by ongoing operations. On the other hand, under the standalone, or direct, EB-5 Program, only direct, full-time W-2 employee positions within the business might be counted. A vital threat of counting only on straight staff members is that personnel reductions as a result of market problems could cause not enough full time settings, potentially resulting in USCIS denial of the investor's request if the job creation need is not satisfied.

The financial model then predicts the number of straight tasks the brand-new service is most likely to produce based on its awaited earnings. Indirect work determined with financial versions describes work produced in sectors that provide the items or solutions to business straight included in the project. These jobs are developed additional hints as an outcome of the enhanced need for items, materials, or services that sustain business's operations.

Not known Incorrect Statements About Eb5 Investment Immigration

An employment-based 5th choice category (EB-5) financial investment visa provides an approach of ending up being a permanent united state local for international nationals intending to spend capital in the USA. In order to make an application for this permit, a foreign capitalist must invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and produce or maintain at least 10 full time work for United States workers (excluding the investor and their instant family members).

This step has been a tremendous success. Today, 95% of all EB-5 resources is increased and invested by Regional Centers. Given that the 2008 monetary crisis, accessibility to resources has been restricted and metropolitan budgets continue to encounter significant deficiencies. In several regions, EB-5 investments have actually filled the financing gap, providing a new, crucial resource of capital for regional economic advancement tasks that renew areas, create and support jobs, facilities, and services.

The Facts About Eb5 Investment Immigration Uncovered

employees. Furthermore, the Congressional Budget Office (CBO) scored the program as earnings neutral, with administrative expenses spent for by applicant charges. EB5 Investment Immigration. Greater than 25 countries, including Australia and the UK, usage similar programs to draw in foreign financial investments. The American program is more rigorous than lots of others, needing substantial danger for investors in terms of both their economic investment and migration status.

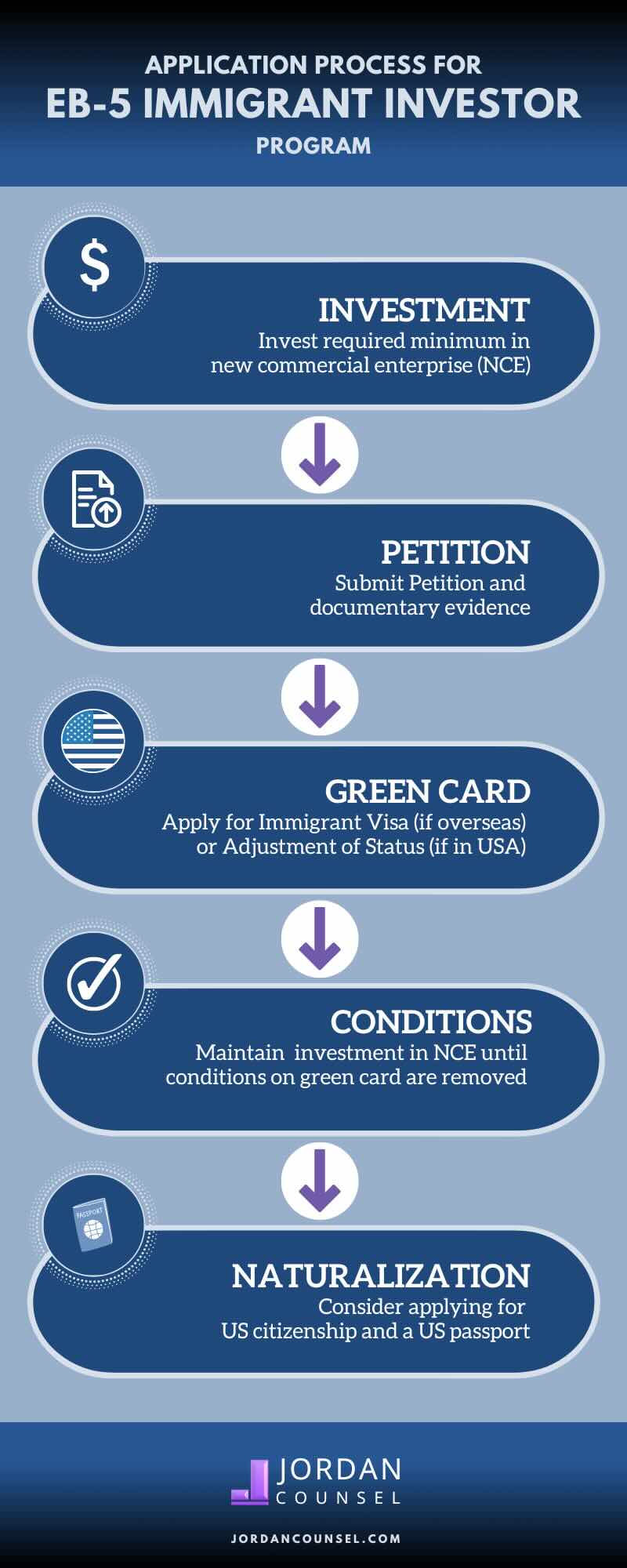

Households and people that look for to move to the United States on an irreversible basis can use for the EB-5 Immigrant Financier Program. The United States Citizenship and Immigration Provider (U.S.C.I.S.) set out different requirements to obtain long-term residency via the EB-5 visa program.: The very first step is to find a qualifying investment chance.

When the chance has actually been recognized, the capitalist must make the investment and submit an I-526 request to the united state Citizenship and Migration Solutions (USCIS). This application has to consist of evidence of the financial investment, such as financial institution declarations, purchase arrangements, and service strategies. The USCIS will certainly assess the I-526 petition and either approve it or demand added proof.

Get This Report on Eb5 Investment Immigration

The financier should get conditional residency by sending an I-485 petition. This application needs to be submitted within six months of the I-526 authorization and should include evidence that the financial investment was made and that it has actually created at the very least 10 full time work for U.S. employees. The USCIS will review the I-485 request and either approve it or demand additional proof.

Report this page